The Gamefi ETF is an opportunity to corner the market of proper exposure to assets in the AVAX gamefi ecosystem. We are also at a time when most of these tokens are at or near the all-time low for pricing. In many ways, the Gamefi ETF could be a simple way for retail to gain diverse exposure to Avalanche-based gamefi tokens with extreme convenience.

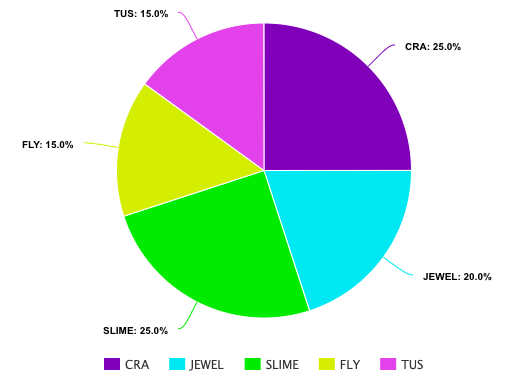

My list for the initial proposal of the Gamefi assets and weighted breakdown is as such:

CRA and TUS from Crabada, JEWEL from DeFi Kingdoms, FLY from Hoppers, and SLIME from Snail Trail. Over time this ETF will gain more gamefi assets and potentially lose some as well. This will come down to both token metrics and associated game metrics.

The idea that a token can do well on a graph while user acquisition or user retention fails to maintain positivity is a real concern. Tracking these analytics in bull markets is key to seeing which protocols users genuinely use. This is one way in which we can attempt to gauge the future price action for this style of tokens.

An ideal integration for this Gamefi ETF would be to pair with an auto-compounder partner like Yield Yak to help users compound rewards from the assets being deployed in underlying strategies.

Lastly, this bundle of assets would allow us to remove some of these assets from other indexes like aHYPE without losing investors who enjoy holding in those assets.