Motivation:

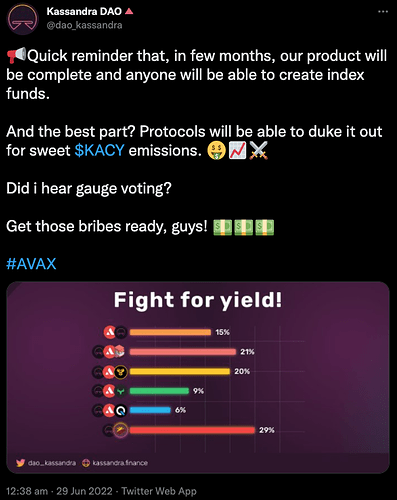

In this discussion, I am referring to a recent tweet from Kassandra:

Gauge voting sounds great, but in my humble opinion Kassandra should focus on incentivizing the key value proposition of the protocol - create & invest in decentralized ETFs, rather than using $KACY for incentivizing LP tokens for 4 reasons:

-

$KACY having exposure to some projects in AVAX ecosystem in form of LP tokens is okay, but I don’t think many LP pairs and deep liquidity is having a significant impact on the key value proposition or future success of Kassandra. So especially with current $KACY prices relative to other protocols in the AVAX ecosystem ($KACY is undervalued imo and has higher growth potential than most other protocols), I don’t think incentivizing LP tokens with other protocols is the best use of $KACY.

-

Liquidity providers = mercenary capital (we’ve learned in this cycle that people will remove LPs as soon as incentives are gone, and find the next best APR). And at this stage, there’s not enough value captured with protocol revenue to sustain these APRs long run.

-

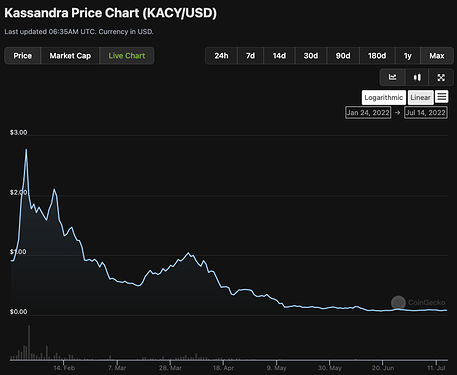

Most LPs are going to sell their earned $KACY. We could see that by looking at on-chain data & recent price action of $KACY (and yes, the market going to hell had something to do with that as well).

-

I have doubts that buying pressure from protocols getting $KACY to vote on the gauge with their token is going to offset the selling pressure from emissions. Altho I have no doubts about the competence of Kassandra team (you guys are rocking it), there are protocols that focus solely on this feature and have significant troubles with keeping this in balance in the bear market: https://www.tokemak.xyz/.

Proposal:

Besides not being in favor of incentivizing LPs, I think there is huge potential for building a gauge system and a stronger use case for $KACY. My proposal is to:

1. Build gauges for ETFs rather than LPs

Rationale:

The first assumption is that gauges for ETFs will make $KACY more valuable for fund managers because they will be able to use it to vote on distribution, incentivize more users to use their ETF & earn more management fees.

The second assumption is that gauges for ETFs will make $KACY more valuable for investors because they can use it to keep voting for their favorite ETFs, decreasing the selling pressure from rewards.

This creates a positive flywheel effect around the key value proposition of the protocol.

2. Decrease or remove incentives for LPs

Rationale:

Having thin liquidity is an advantage at this stage, as it requires less buy pressure to increase mcap of $KACY. Higher macap → higher $KACY price in treasury → more value we can distribute for rewards.

This will also increase the happiness of your early evangelists (in this industry we build our #1 fans by allowing them to get in early and take them on the upside journey with us). Only when we get to 50x from where we are now (that’s less than $4 per $KACY, I’d start considering deepening liquidity → making $KACY price more secure).

- Build gauges for ETFs and decrease rewards for LPs

- Build gauges for LPs and keep high rewards for them

- Build gauges for LPs + ETFs and keep high rewards for both

0 voters